Hello, all community crypto.

Since its inception, Qurrex has attracted a very smooth interest not only from crypto community but also from professional players and investors who always invested.

from now on it’s obvious – cryptocurrency trading looking for new generation trading platforms: sustainable, transparent, efficient.

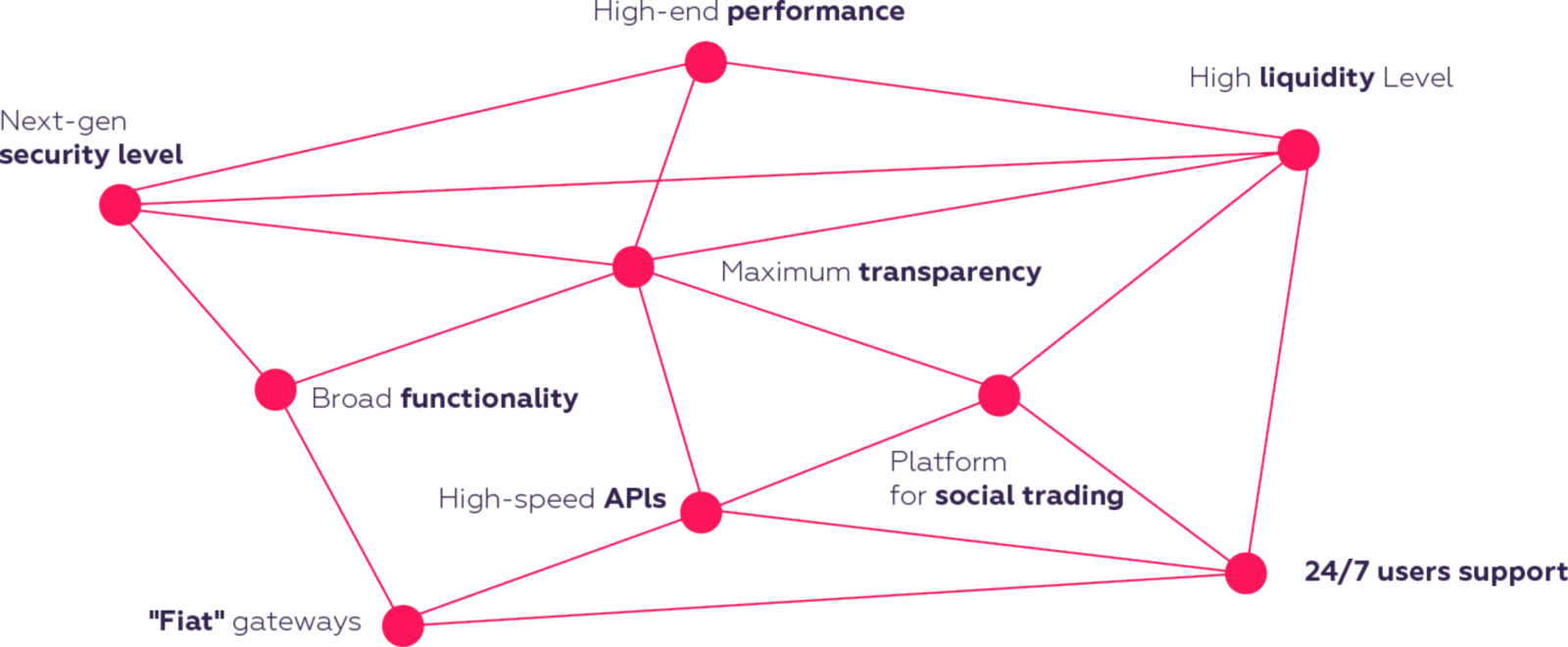

Qurrex is the first hybrid cryptocurrency to integrate the traditional stock exchange industry infrastructure with a decentralized network. This means that Qurrex combines a centralized industry platform with a decentralized blockchain protocol in which centralized exchange will serve as one of the nodes.

Qurrex wants to provide high-performance trading and win the trust of professional exchange players by substantially improving market liquidity. Why liquidity is so important? because when traders choose a crypto exchange, they focus on transparency, security, and most importantly its liquidity. High liquidity is required to enable traders to trade marginally. According to Qurrex, any exchange managed to overcome some concerns. However, at this time, there is no address exchange of all problems.

Background Qurrex

In November 2016, a group of like-minded people started working on the first hybrid cryptocurrency exchange with the added sense of social trade and investment. The team consists of experts who have years of experience working in the currency market, developers of trading terminals, and the founders of the successful stock exchange and futures exchange. They all see significant potential for applying best practice from the traditional sector to the cryptocurrency space.

Solution Overview

Originally, the Qurrex platform was designed exclusively as a centralized cryptocurrency exchange system. The reason for this was related to the team’s background: having worked for over 10 years on the creation of various exchange markets and broker systems and products for the traditional markets, the company inadvertently became adherents of this approach. However, the research into distributed networks leads to new approaches and tools for solving many of the problems that the Qurrex has encountered over the course of recent years.

Here Qurrex refers, first and foremost, to the need to increase the liquidity of separate instruments, as well as to increase clients’ confidence in unregulated infrastructure providers. The outcome of company investigations is the understanding that, in order to create an effective exchange system and meet the demands of a wide circle of users, what is necessary is the harmonious merging of centralized and decentralized elements.

In order to provide clients with user-friendly tools for executing operations and maximizing liquidity, the company formulated platform approach in the following way:

• The centralized exchange (CEX) will, in the long-term, remain the most effective solution.

• At the current time, it is only within a centralized infrastructure that the effective creation of a partial pre-deposit of funds is possible (the function of guaranteeing the fulfilment of the transactions of the infrastructure) and this technology, in Qurrex view, will ultimately be introduced to the cryptocurrency market;

• Decentralized exchanges (DEX) with high capacity remain, unfortunately, an unattainable goal in the medium term, whereas clients need a high-quality

service now.

CEX: Niche Products And the universal exchange

The development of the financial services and the development of the services of the financial institutions and the establishment of a universal enterprise that provides clients with a wide range of services. the single entry point for an exchange’s entire functionality. The leading players in the classic finance, banking, and brokerage businesses have long been catering to customers by developing appropriate product lines. By contrast, in the cryptocurrencies and crypto assets sector, the majority of players have until now maintained precise specializations and a sharply defined niche quality.

Company identify the following types of cryptocurrency exchanges:

Platforms that do not accept fiat currency, with a wide selection of cryptocurrency pairs (for example Poloniex and Bittrex);

Platforms that do not accept fiat currency and that specialize in low-liquidity coins/tokens (from recent ICOs) and the trading of one or two popular cryptocurrencies (for example CoinExchange, C-CEX);

Exchanges that accept fiat currency and specialize in a range of traded cryptocurrencies/coins most popular with platform speculators (for example Bitfinex, Bi thumb);

CEX: Security

The exponential expansion of the cryptocurrency sphere and the rise in demand for services in converting fiat currencies into crypto assets has aided the development of centralized exchanges. As a result, members of the blockchain community have started to transfer control over ownership of decentralized currency to centralized exchanges. For ease of access to the conversion functionality and speculative trading, many have begun using exchanges to store their fiat and cryptocurrency funds.

DEX: The issues

Qurrex today, there are a number of projects for organizing the decentralized exchange of cryptocurrencies, some of which have already been launched and some of which are still in development. Initially, these can be exchanged between different blockchains, such as Bitshares, Waves DEX, nvo.io, or those exchange protocols within one network (like Ethereum) such as EtherDelta, OasisDex, 0x , Bancor, and others.

All of these projects seek to address the following challenges:

• secure storage of funds/crypto assets;

• the vulnerability of the central link/intermediary;

• the search for a counteragent interested in a deal;

• the transparency of completed operations;

DEX: Current solution

Attempts by developers to solve the problem of speed, liquidity, collateral and the algorithm for matching trading operations have led to the rise of decentralized trading platforms dependent on centralized services, which resolved the issues of keeping order books, keeping reserves for collateral, matching incoming orders and selecting the technology for mutual settlements. Such centralization raised the question of solving the global problem of the presence of a vulnerable middleman.

The key features of the solution

Transparency: Financial Openness

• who is controlling and managing the exchange’s activity and, consequently, the funds which the users are depositing in their exchange accounts;

• the way the funds deposited by users in their exchange accounts are being used;

• whether there is a balance between the fiat money and the cryptocurrency assets circulating on the exchange platform;

Advantages

Best Execution of Qurrex:

Each node of hybrid exchange provides the Best Execution service to its users. Companies operating in countries with emerging financial markets are required to provide the Best Execution service. In Qurrex this service is implemented by a special module – Smart Order Router, which is part of all blockchain nodes, including centralized node (CEX).

How will the platform work?

They already have a mockup to show investors and crypto enthusiasts how the platform will work.

The synergistic organization will allow the DEX component of the hybrid to coordinate liquidity pools from the available network of nodes on a transparent and intermediary-free secure network. to the aggregated liquidity pool.

The duo will function best with the inclusion of smart order router, which ensures that the best prices and liquidity channels are accessible to the user.

What is platform modified integral infrastructure of traditional stock exchanges with decentralized networks?

While searching for the optimum tech solution, DEX will send the nodes with the best prices, In summary, the platform will be the one of the best forex trading platforms for the optimum speed and liquidity values of a single order book drawn from multiple nodes of DEX and CEX.

They will also ensure that their top-notch matching trading algorithm, an efficient security landing platform and data protection services.

Detail Penjualan Token

- Token symbol: QRX

- Token standard: ERC20

- Token type: utility

- Total token supply: 70m

- Total token for sale: 55m

- Total token for pre-sale: 17m

Crowdsale Analysis – Details & Token Supply

Total Token Supply: 70 million QRX

Token Type: ERC-20

Distribution Token:

Crowdsale 78.6%

Bounty fund 4.3%

Loyalty Program 6.4%

Pre-ICO investors 3.6%

Team 7.1%

ICO Sale Phase:

Whitelist starts 7th February

Presale: 27 February – 7 March 2018

Main sale 19 March – 7 April

Token Price: 800 QRX = 1ETH or (BTC / LTC equivalents)

Crowdfunding Usage:

Team 10.3%

Operation costs 11.1%

CEX 29.5%

DEX 7.7%

Liquidity program 12.9%

Legal 4.0%

Marketing 10.3%

Interface 11.5%

As you can see, each exchange is considered a competitor. However, none of the successful exchanges meets all the requirements of the merchants. You can find the complete comparison here.

Kraken is regarded as one of the biggest competitors based on the functionality they offer, although they lose many important functions. Why Kraken got good grades?

Have integrated KYC & AML

Enable fiat deposit

Offer margin trading

Mobile website version available

A wide range of trading orders

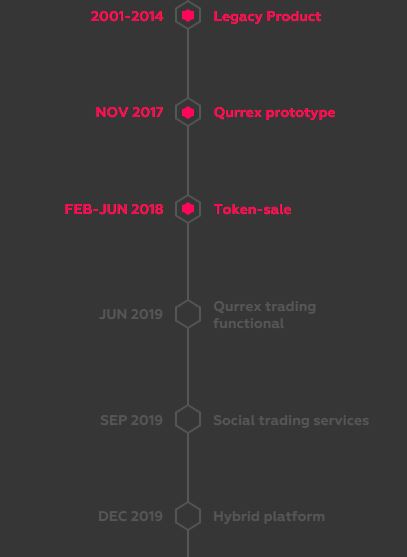

ROADMAP

MORE INFORMATION:

- Website: https://qurrex.com/

- Whitepaper: https://drive.google.com/file/d/1klzZPHdjCBnurHCJjJbjwsed_5rx4W1U/view

- Facebook: https://facebook.com/profile.php?id=138158276942774

- Bitcointalk: https://bitcointalk.org/index.php?topic=2899211

- Telegram: https://t.me/qurrex

- Twitter: https://twitter.com/qurrex

ALEX789

https://bitcointalk.org/index.php?action=profile;u=1653045

ETH: 0x5f5f506A001A179b8eE67214a7754Bfe04ffadE0